People talk about us on Facebook and Google, too

Join us! We have a great community and live events with our team of credit experts.

Update: First File Delivered 7/3

Reported Status... "Processing" Learn more

Update: First File Delivered 7/3

Reported Status... "Processing" Learn more

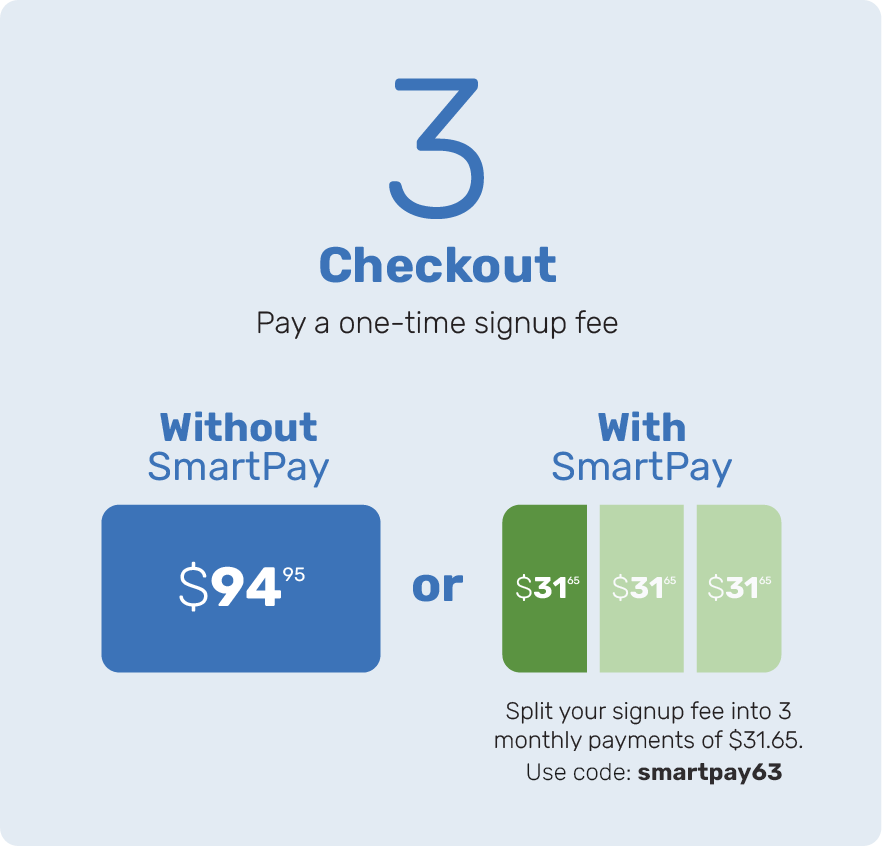

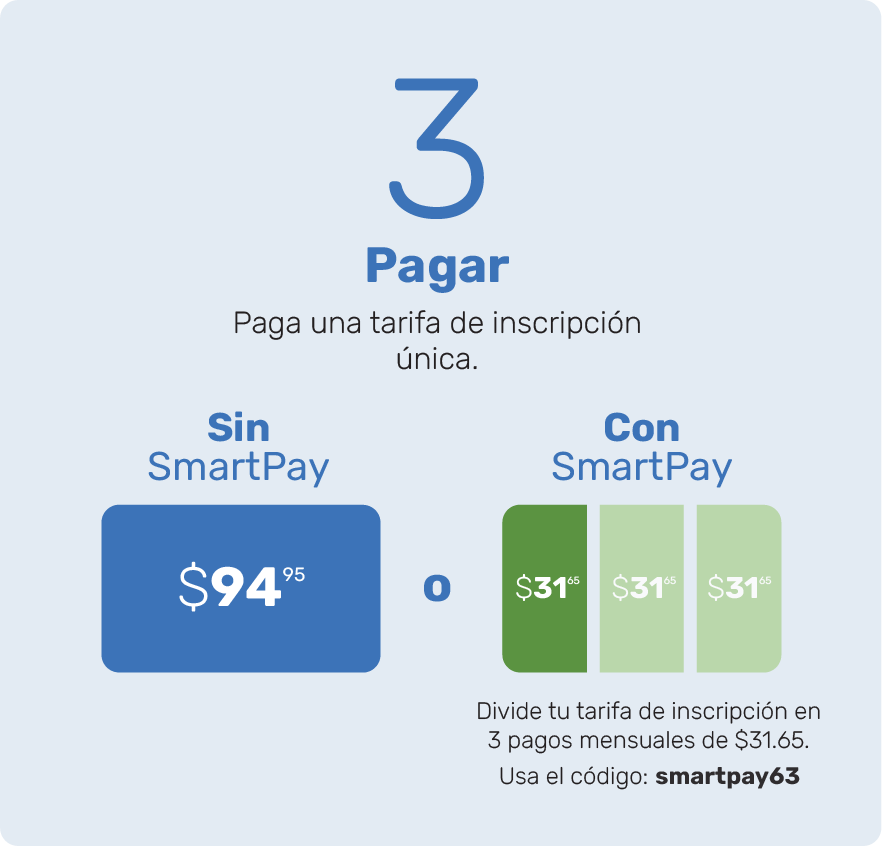

with SmartPay Please note: Our satisfaction guarantee still applies with SmartPay. Simply cancel within 7 days after your initial rent history being reported to receive a full refund (tradeline will be removed at the time of refund). If you elect to use SmartPay, you agree to pay all 3 installments at the time billed. Failure to pay installment will result in immediate removal of your tradeline with no further refunds allowed. Ten en cuenta: Nuestra garantía de satisfacción sigue aplicando con SmartPay. Simplemente cancela dentro de los 7 días posteriores a que se hata informado tu historial inicial de alquiler para recibir un reembolso completo (la línea de crédito será eliminada en el momento del reembolso). Si eliges usar SmartPay, aceptas pagar las 3 cuotas en el momento que se facturen. El incumplimiento del pago de cualquier cuota resultará en la eliminación de tu línea de crédito sin la posibilidad de reembolsos adicionales.

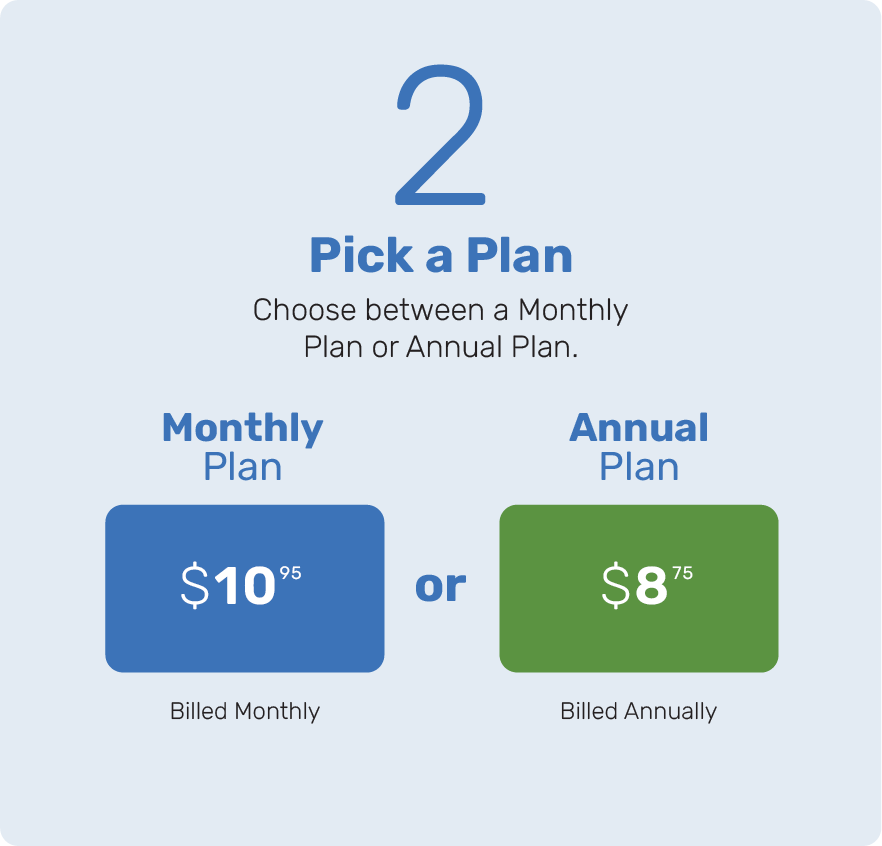

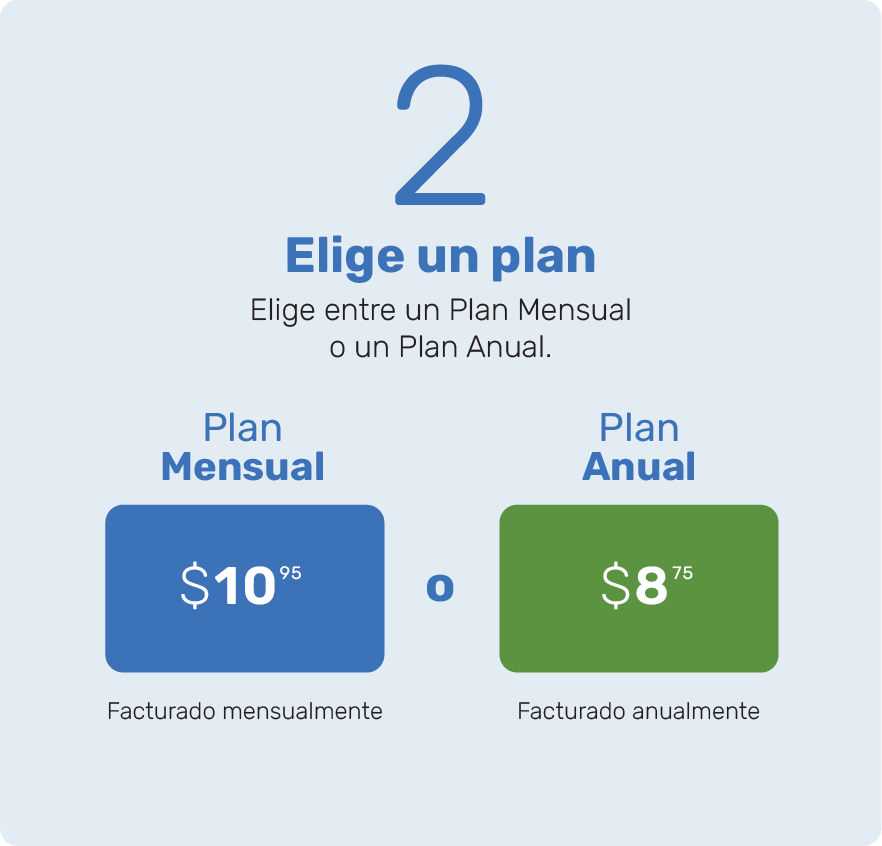

+ $94.95 one-time signup fee

or

3 monthly payments of $31.65

Enroll NowYour $10.95 subscription begins when your rent history is verified and ready to be reported, then bills monthly.

We update your rental tradeline to reflect your on-going rent payments. Cancel at any time.

Manage your account, view your credit score, and get credit tips.

A dedicated credit specialist to assist you on your path to better credit.

24 months of rent history reported to TransUnion, Equifax, and Experian.

We update your rental tradeline to reflect your on-going rent payments. Cancel at any time.

Keep your credit healthy with access to our financial tips and resources.

This free service allows us to automatically verify your rent payments, limiting contact with your landlord.

Spouses and Roommates can sign up at a discounted fee of $50.

Add an additional landlord for $50.

+$94.95 one-time signup fee

or

3 monthly payments of $31.65

Enroll NowYour discounted annual subscription is charged upfront at signup and renews each year on the same date.

Free access to your most recent TransUnion credit score so that you can see how much your score went up.

Manage your account, view your credit score, and get credit tips.

A dedicated credit specialist to assist you on your path to better credit.

24 months of rent history reported to TransUnion, Equifax, and Experian.

We update your rental tradeline to reflect your on-going rent payments. Cancel at any time.

Keep your credit healthy with access to our financial tips and resources.

This free service allows us to automatically verify your rent payments, limiting contact with your landlord.

Spouses and Roommates can sign up at a discounted fee of $50.

Add an additional landlord for $50.

* Reporting time will depend on cooperation of your landlord and timely receipt of any documentation needed. This fee is non-refundable.

From credit invisible to credit invincible- These customers are on their way to financial success

If you’re not happy with the initial results, let us know within 7 days and we will remove your rent history from your credit and issue a complete refund.

Did you know? The longer you report your rent, the more impact it has on your credit. Just like a credit card, showing you pay your rent on time over multiple months/years plays an important role in building your credit.

Need your credit

boosted…yesterday?

Jump to the front of the line and get your past 24 months of rent reported in 3-5 days.

$25 to be RentReporters VIP*

* included in annual plan

Get StartedJoin us! We have a great community and live events with our team of credit experts.