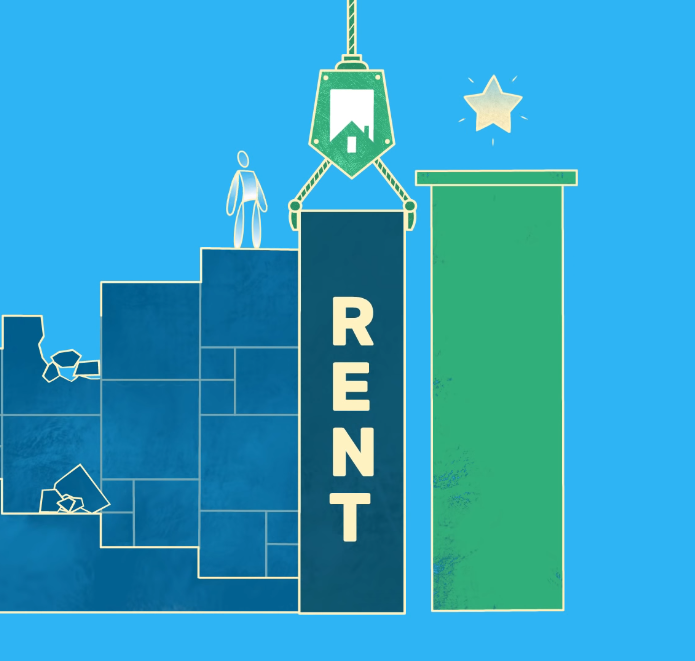

Save Your Cash

Pay With Referrals

Smart Money Tip.

Share your referral code and earn $25 in bill credits for each referral. Log into your RentReporters dashboard and click on “Refer a Friend and Save”, and email your code directly to your friends. Leave a Google/Facebook review and earn a free month of service.

Is it important to check my credit report?

Yes, your credit report is what lenders use to determine whether to grant you credit.

It is not uncommon to find errors on your credit report so check periodically to make sure it’s accurate.

How do I check my credit report to see what is on it?

You can receive a FREE copy of your credit report from all three bureaus here http://www.annualcreditreport.com/ and access is immediate.

How often should I be checking my credit report?

You are eligible through 2026 to get 6 free reports a year so consider checking your report every other month.

What if I find a mistake on my credit report?

It is important that you dispute any inaccuracies. You can find complete instructions here https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/.

Am I allowed to miss payments or make late payments during Covid-19?

Unless you have reached an accommodation with your lender it is important to make payments timely otherwise you run the risk of those payments being reported on your credit report as late.

Is it important to pay off my credit card balance each month?

Paying off your credit card balance each month helps keep your finances in good order. Carrying a credit card balance is generally not advisable unless it is for an emergency short term need. The interest charges associated with carrying a balance can be prohibitively expensive. Consider borrowing from family and friends first.

Does it matter how much of my available credit I use?

Yes, generally speaking limit your use of your available credit to only 30% of the credit line. If you need to use more during a month consider making a payment during the month to keep your utilization percentage lower.

How does reporting my on-time rent history with RentReporters help my credit?

Reporting past and current rent payment history helps in several ways.

Join us! We have a great community and live events with our team of credit experts.