Everything You Need To Know About Paying Back Student Debt

CollegeRentReporters

March 18, 2021

11 mins read

College is expensive and if you’re like most undergraduates, you probably took out a student loan. In fact, nearly 70% of graduates have student debt and 44 million Americans have a total of $1.71 trillion in student loan debt!

When it’s time to pay back those loans, it’s important to do your homework so that you don’t have more student loan debt than you anticipated. Here’s what you need to know about paying back student loans:

- Interest on a student loan starts as soon as you obtain the loan. Make sure you know what type of loan you have, as that will determine the interest rate.

- Most student loans have a grace period, the waiting time from when you graduate to when you need to start paying back your loans. Your grace period will depend on what type of loan you have.

- If you can prepay your loan, you’ll save money.

- If you decide to prepay your loan, send a letter to your loan servicer and let them know your payment is a prepayment.

- Otherwise, your prepayment might be credited against a future payment rather than being applied toward your loan balance.

Different Types Of Student Loans

The numbers can be daunting if you’re trying to pay your way through college. Public, four-year, out-of-state schools set students back about $27,000 for tuition, fees, room and board, with private schools costing about $41,000.

Few students have that kind of cash available so they take out loans to finance their educations. At this point, they haven’t achieved their full earning potential yet and may have spotty or nonexistent credit histories. Alternative loans exist for students with inadequate credit, but the federal government may be your best option.

Federal Student Loans

The U.S. government won’t factor in your credit score when you apply for a student loan. Even if your credit is poor, a cosigner will not be required. Federal student loans are based on need, so the less income you have, the more likely it is that you’ll qualify.

Another benefit of federal loans is that they generally offer low interest rates, sometimes significantly lower than private loans. Look for those that are subsidized where the government will pay the interest on your behalf while you’re still in school. A potential drawback is that federal student loans won’t always cover the entire cost of your education.

You can determine your eligibility as well as the type of federal loan you’re eligible for by completing the Free Application for Federal Student Aid or FAFSA online at www.fafsa.ed.gov.

Private Loans for Students

A private student loan is no different than any other loan. Unlike the federal government, private lenders will check your credit score because private lenders want assurance that you can and will pay the loan back.

This makes private loans for students with poor credit more difficult to get and lenders will likely charge higher interest rates if they approve you at all.

Peer-to-Peer Lenders

Another less common alternative is peer-to-peer lending. This is pretty much what it sounds like — an individual is willing to lend you money directly, cutting out the financial institution middleman. It might sound like an ideal solution, but there are pros and cons to such an arrangement.

The positive is that you may be able to negotiate better loan terms than you would with a private lending institution, even with a cosigner. But Debt.org cautions that these lenders often like to remain anonymous. They may be willing today but may change their minds tomorrow.

Peer-to-peer lending is risky, but if it’s your only option, scout around online for a website that will link you to someone who is willing to help.

Consider a Cosigner

So what if you’re a student with little or no credit and don’t qualify for a federal loan? Or perhaps the federal loan doesn’t cover the full cost of your education?

Most private lenders will overlook a low credit score if you have a cosigner with very good credit. Maybe that’s your parent, another relative, or a friend. This tells the lender that if you cannot pay off your loan, your cosigner can and will.

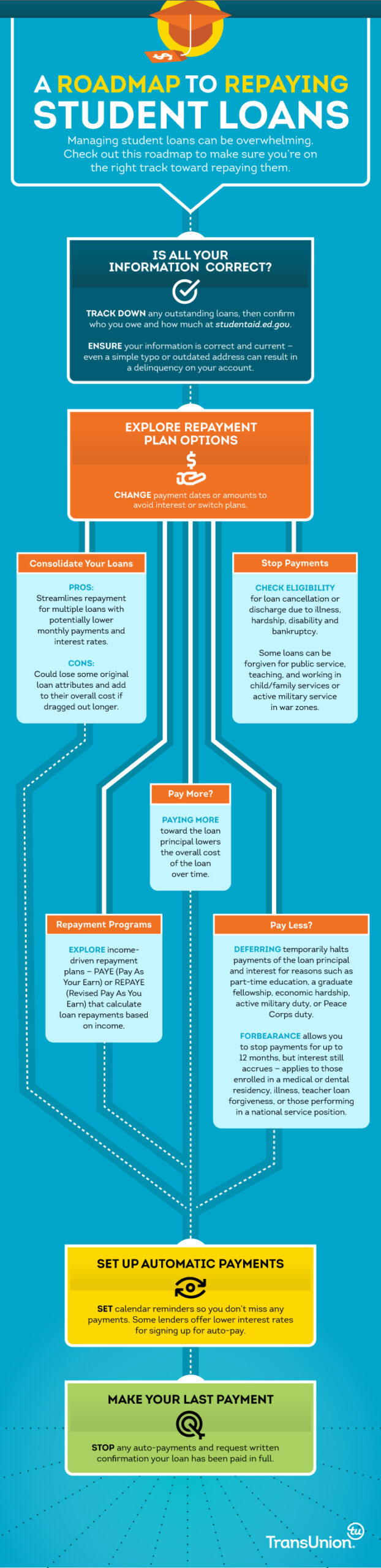

Picking the Right Repayment Option for You

When it comes to paying back your student loans, make sure you do your homework and find the right repayment plan for you. Why? Because these loans are “non-dischargeable.”

In other words, no matter what, you must pay off these loans. They will follow you until you pay them off. There’s no right or wrong answers when it comes to paying back loans but here are some questions to ask.

How quickly can you pay off your loans?

Pay off your loans early by paying more than the minimum. You’ll save on interest but will want to consider your future plans. You might need that extra money to pay for a move or a new car.

What’s your personal budget?

Creating a budget is important . Will you be able to pay your rent, credit cards, utility bills, and student loans each month? Make sure that your repayment plan fits in your budget so that you don’t miss any payments.

What’s your interest rate?

If you have a high interest rate – let’s say over 5% – then you should make paying off the student loan a top priority. The higher the interest rate, the longer it can take to pay back your debt.

The key to success here is commit to what you can afford and pay your debts on time. This includes your student loans, credit cards, cell phone, utilities, and rent. Only by making on-time payments, will you be able to build and improve your credit score.

Should You Prepay Your Student Loan?

Like any other loan, the quicker you can pay off your student debt, the more money you can save.

So should you prepay and make extra payments to reduce the balance of your student loans?

The quick answer is YES.

There is no downside but its important to establish your budget. Will you be able to pay all your other bills, like rent, utilities, and cell phone?

If the answer is yes, then you should make a prepayment. Prepayments don’t come with penalties so make them whenever you can afford to. You’ll save money by reducing the total interest paid over time. If you have more than one loan, focus on the one with the highest interest rate.

Remember, if you decide to prepay your loan, send a letter to your loan servicer to let them know that your payment is a prepayment. Otherwise, your prepayment might be credited against a future payment rather than being applied toward your loan balance.

Student Loan Forgiveness

There’s been a lot of talk in congress about canceling student loan debt altogether. Here’s where things stand now.

Canceled Student Debt Is Now Tax Free

Under the new $1.9 trillion stimulus package signed into law, any student loan debt forgiven by the government is now tax free.

Previously, student loan debt would have been taxed at your normal tax rate. For the average student borrower, this would work out to $2,000 in additional taxes for every $10,000 forgiven.

This provision of the stimulus bill will last until 2025. It could either be extended or become permanent.

Student Loan Talks In Congress

President Biden announced his support of $10,000 of student loan forgiveness through executive action, but members of his party are pushing for a more aggressive $50,000 in loan forgiveness.

The more aggressive $50,000 proposal would allow up to $10,000 of student loan to be forgiven upon each year you complete eligible public service, up to 5 years in total.

Either of these plans is likely evolve and face significant hurdles being signed into law. Critics argue that forgiveness will not stimulate the economy because the saved money will be put into savings. They also believe it is unfair to those who have already paid their loans and sends a message that is OK to not repay loans.

Proponents however argue that student loan borrowers were already in a state of crisis before the COVID-19 pandemic, with over 1/3 of student borrowers in delinquency or default.

Choose Your Student Loan Path Wisely

Your student loan choices affect your credit history and your credit history will follow you for life. So making wise, thoughtful decisions around your student loan path is so important! Your credit can can impact your ability to get a cell phone, utilities, an apartment, or even a job.

By paying your bills on time, you can improve your credit score and gain access to better financial products to get what you need in life.