How to Save Money By Consolidating Your Credit Card Debt

RentReporters CommunityRentReporters

December 13, 2016

5 mins read

One of the biggest obstacles to financial security is a heavy debt load. The average American household with debt carries a $15,675 balance on their credit cards. At an 18% average interest rate, the interest alone costs $2,630 each year. This is a huge financial burden. Imagine what you could do if you had that money in your own pocket.

Unfortunate economic factors play a role in increasing debt loads for many people. For some, it is the result of past irresponsible spending. Yet for many households, it is about a widening gap between the rise in the cost of living and increases in household income (29% vs. 26%). This gap can quickly become significant for those with health problems, student debt, or living in an expensive rental housing market. When that gap gets big, extensive credit card usage and consumer debt are often the result.

Not all debt is equal – financially or psychologically. Mortgages and auto loans can boost your credit score, while the high interest rate of credit cards can decrease your score. We also know that there is a heavy emotional burden that comes with credit card debt. Many Americans perceive it as embarrassing and see it as carrying a real stigma.

If you have significant credit card debt – know that you are not alone. There is hope and a solution for putting a big dent in that debt – either by a balance transfer and 0% interest credit card or simply by qualifying for a lower interest rate on your balances.

How can you make that happen? It’s all about increasing your credit score so you can qualify for those lower interest rates and better terms.

Increase in Credit Score Drives Qualification for 0% Balance Transfer Credit Cards

If you don’t have a good to excellent credit score today, it’s unlikely that you can qualify for one of those 0% balance transfer cards. But if you have even a fair (660) credit score, increasing your score by just 20 or more points can put you into the 680-720 credit score range that allows you to qualify. Just improving your credit score a little can qualify you for a lower interest rate that in turn can save you thousands of dollars each year.

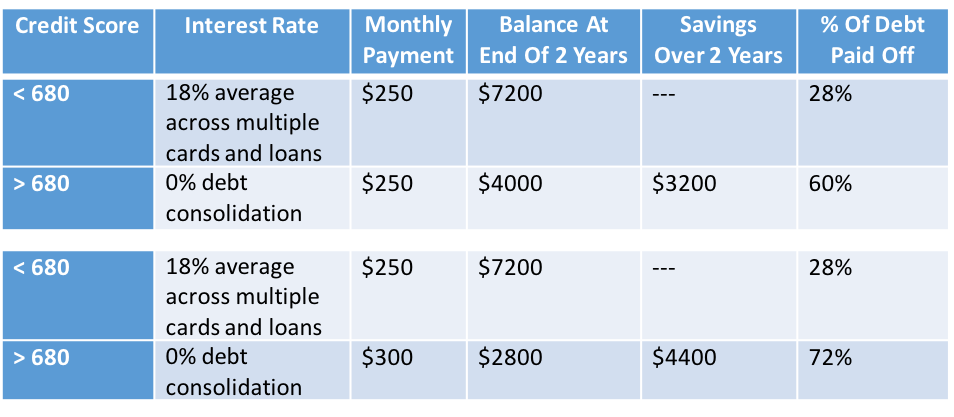

Let’s look at an example of an individual with $10,000 in credit card debt. How much interest can they save in just two years when they are able to qualify for a 0% card instead of their normal 18% interest rate? Remember that at an 18% interest rate, paying $250/month is just a bit more than the monthly minimum payment (in the form of the monthly interest accrual).

Here’s what happens when you increase your credit score:

(1) From Fair to Good/Excellent: By qualifying for the 0% balance transfer card and continuing to pay what had been the monthly minimum payment ($250), you can save $3,200 in interest payments over just 2 years. And you will have increased the percentage of credit card debt that you have paid off from 28% to 60%.

(2) From Fair to Good/Excellent: By qualifying for the 0% balance transfer card and paying a bit more ($300) than the prior monthly minimum, you can enjoy the same interest savings and additionally reduce your credit card debt from $10,000 to $2,800 which is a reduction of 72%.

Finding a Solution to Raising Your Credit Score

If you want to get out from under the financial and emotional burden of your credit card debt, you need to find a way to qualify for a lower interest rate credit card or even a 0% balance transfer card. That can be difficult if you are a renter and don’t have the benefit of a tradeline such as home mortgage payments on your credit report.

RentReporters believes that if you have a history of paying your rent on time, you have been demonstrating financial responsibility, and your credit score should reflect that. An increase in your current fair credit score just might get you into the good/excellent range of 680-720, and on your way to paying off that credit card debt.

You can learn more here.