The Long-Term Impact of Student Loan Debt

CollegeRentReporters

April 8, 2021

3 mins read

The long-term impact of student loan debt is overwhelming. When it’s time to pay back loans, it can be overwhelming. Don’t fret. With a plan, there’s hope.

You’re in college to earn a degree to get that dream job. And like millions of Americans, you probably had to get a student loan to help pay for tuition, books, and living expenses. That means when you graduate, you’ll have student debt.

Unfortunately, student debt has long-term effects on the daily lives of young adults just like you. You may find yourself delaying important life decisions, such as finding a place to live on your own, buying or leasing a car, and saving for retirement.

If you’re not careful, your student loan debt can quickly accumulate – and it’s understandable why, as the life of a college student means you’re busy going to class, getting good grades, and spending time with friends. Paying back student loans is probably not high on the priority list.

Before you graduate, make sure you view your loan dashboard to make a payment plan. For example, do you know if your loans are subsidized or un-subsidized? Also, if you are using credit cards and are paying only the minimum each month, do you know your cards’ interest rates?

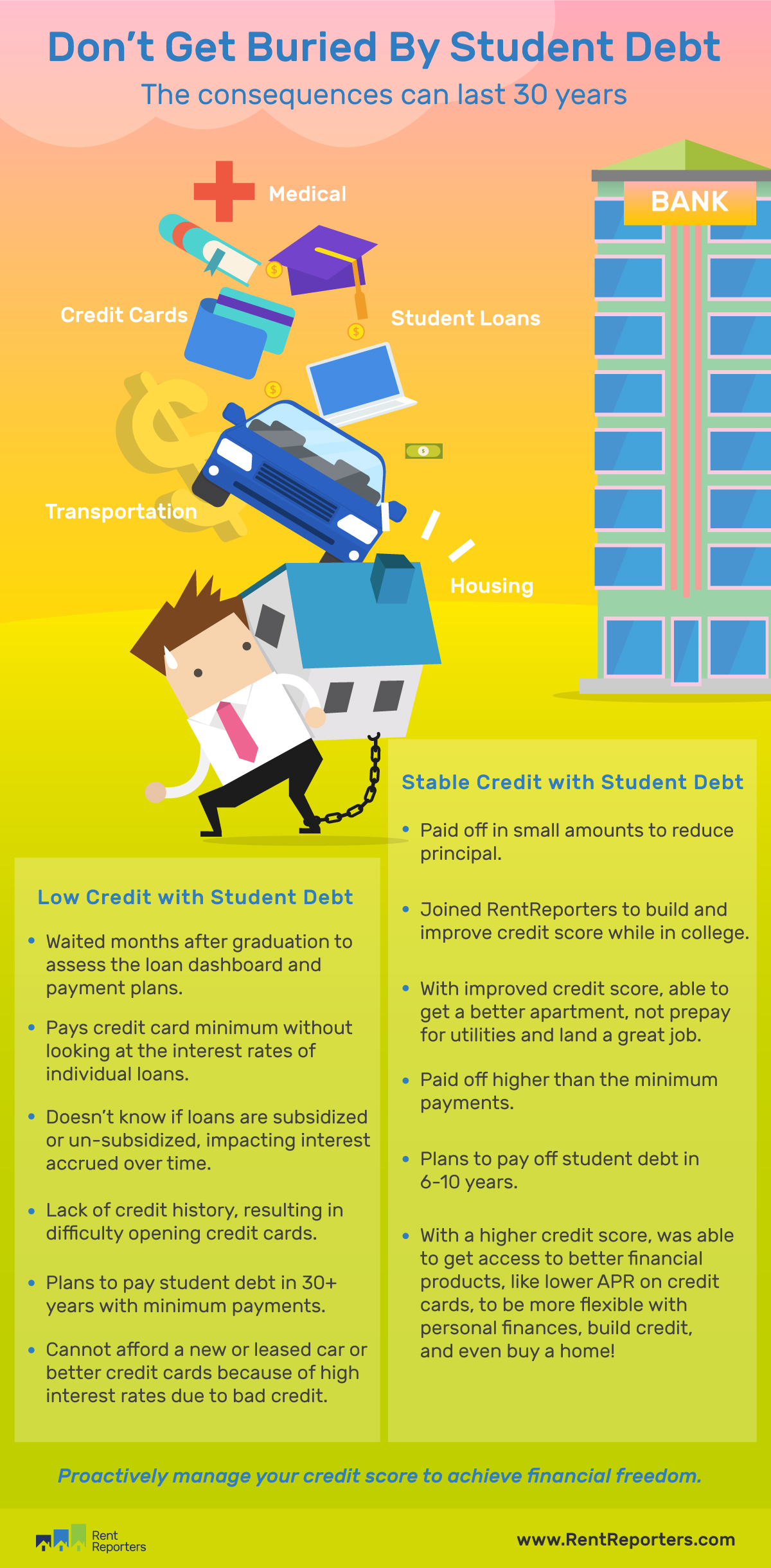

To help you get there, here are a few steps you can take so that you don’t get buried by student debt:

- Make a repayment plan as soon as possible

- Start paying off small amounts of your student loans to reduce principal

- Pay more than the minimum of your credit cards so that you’ll owe less in total interest in the future

- Join a resource like RentReporters to report on-time rent payments and start improving your credit score before you graduate

So, with a plan in place, you can pay off your student debt sooner, and in the process, improve your credit score. And that means not only can you get that better apartment, not prepay for utilities, and land a great job, but also, you can gain access to better financial products, like lower APR on credit cards. And that’s all a good thing, because now, you can start making all those important life decisions!

If you need more help with understanding how you can work on your credit today, here’s a few tips that can help you build your credit. As you improve your credit score, you will see that this will unlock better financial opportunities for you and save you thousands of dollars in interest.