Fair, Good, or Excellent? What Each Credit Rating Gets You

Credit Education , Credit ScoreRentReporters

April 6, 2021

8 mins read

We talk a lot about the importance of a good credit score and steps you can take if you want to raise your score. But do you know why? A credit score that falls in the good or excellent range will get you better terms and lower interest rates than having a score that’s rated fair or poor. This is because your credit score is a reflection of the level of risk you present to potential lenders when it comes to paying them back on a loan or credit card. While there are variables in scoring models and lending criteria among lenders, it’s important to know in a general way where you fall on the credit score range, as it can help you understand which financial products you’re eligible for and the terms you might expect.

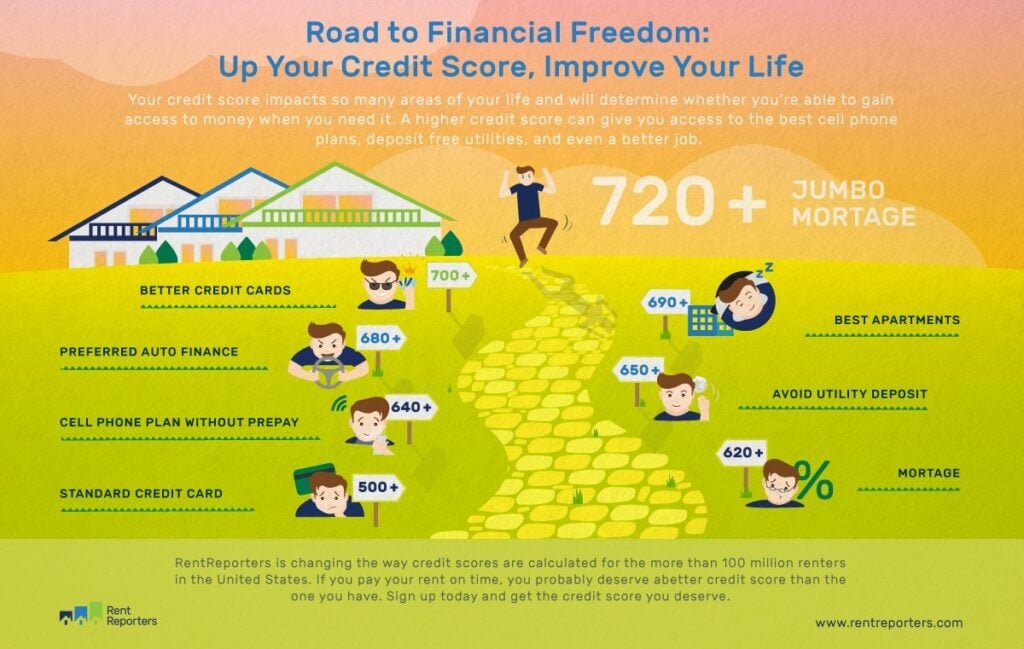

Below is a general guideline of how your credit score range (whether FICO or VantageScore) can affect your financial options.

- Excellent (Above mid-700s)

While an excellent credit rating doesn’t guarantee the loan you want, people with top credit scores are likely to not have an application denied based on their credit scores. If your credit score falls in this range, you have the greatest flexibility in shopping around for the best package you can find. You’re more likely to receive a low interest rate and have the greatest number of options available to you for choosing repayment periods or other terms. - Fair to Good (Low-600s to mid-700s)

When your credit score falls in the fair to good range, you’ll still have the ability to compare your options and look for the best package from different lenders — but may not be able to secure the absolute best terms. You may not get the lowest interest rate available and you may also not have as much flexibility in payment terms. - Poor to Fair (300 to low 600s)

Having a poor to fair rating means you may not be able to get approved for a loan or unsecured credit card. If a lender or creditor does approve your application, you may be subject to higher interest rates and/or have fewer repayment options. If you’re looking for a credit card, you may have better luck with a secured credit card.

What each credit rating get you:

If your score is lower than 600, you may be able to get credit, but it will often come with high fees and interest rates. You can see in our road to better credit image above, as you improve your credit score, you can unlock some great financial opportunities. We already mentioned a few of the other ways that credit scores can impact your life. We’ll cover some of the lesser-known ones below.

- Mortgage: The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage you’re trying to obtain. Scores differ whether you’re applying for a loan insured by the Federal Housing Administration, better known as an FHA loan; one insured by the U.S. Department of Veterans Affairs, known as a VA loan; or a conventional mortgage loan from a private lender. Most lenders require a minimum score of 720 for approval of a jumbo mortgage of $600,000 or more. Fannie Mae and Freddie Mac approved mortgages with fixed rate loans with minimum score of 620 and adjustable rate mortgages with minimum credit score of 640.

- Apartments: Most people know that a good credit score is required to take out a mortgage loan, but not that apartments often require good credit as well. Landlords will often look at your credit score to determine if you will be able to make rent on time. Those with a low score may pay higher deposits, or may not be approved at all. The higher your score can land you into the best apartments in better neighborhoods with the best amenities. If you fall into the lower ranges, you may have to settle for an apartment that you can get approved in. This at times can make you feel stuck in a bad rental situation where you are not in a secured neighborhood or your landlord failing to upkeep your property.

- Loans and Interest Rates: Unfortunately, not all lenders have the same preferences and criteria, so scoring ranges may differ from lender to lender. This will often depend on what credit model the lender uses (FICO vs VantageScore). Depending on where you land on the credit scoring spectrum, it can determine your interest rate. The lower your credit score, you can lose the opportunity for a lender to approve your applications. If your application does get approved, you’ll likely have to pay more fees and higher interest rates. If you’re looking for a credit card, you may have better luck with a secured credit card. Standard credit cards with low credit limit, no rewards, no membership fees, and no prepayment. APR usually ranges between 15.65% and 36%

- Car Loans: Financing is split into two types of cars – economy cars, with credit score starting at 690 for standard sedan and 710/715 for standard SUV, and luxury cars with credit score of 680/710. For luxury cars, credit score is only 30% of the decision, as they also take into account other factors, like credit history, current income, and check stubs. Fannie Mae and Freddie Mac approved mortgages with fixed rate loans with minimum score of 620 and adjustable rate mortgages with minimum credit score of 640.

- Employment: 47% of employers check credit scores during the application process. They check because having a high credit score can be an indication of trustworthiness. However, having a low score can indicate a candidate is less trustworthy or not financially savvy.

- Insurance: Since credit is linked to reliability, many insurance agencies will take it into account. They calculate their own credit-based insurance score to predict the likelihood you will have an accident or file a claim, and credit scores are a part of this calculation.

- Utilities: When you open an account to get water, electricity and heat at your house, the company will likely run your credit. If your credit score is low, you may have to pay a hefty deposit. This is because you will be perceived as a more risky account than one with a high credit score.

Take Our FREE Credit Literacy Quiz!

In just a few minutes, discover your credit knowledge level and get instant access to a FREE credit education course tailored to you!