How To Calculate Your Debt-To-Income Ratio

Homeownership , Personal FinanceRentReporters

April 23, 2021

7 mins read

When applying for a mortgage, the debt-to-income ratio (DTI) is one of the factors, along with credit score and income, that lenders use to determine your mortgage eligibility.

If you’re hoping to qualify for a mortgage or a refinance, you’ll need to know about your debt-to-income ratio and how to improve it if needed.

What is a Debt to Income Ratio?

Your Debt-to-Income-Ratio (DTI) is a reflection of your financial health. Simply put, it is the ratio of your debt compared to your income, calculated on a monthly basis This percentage gives you an idea of where you are financially and is a valuable tool for calculating comfortable debt levels, and whether or not you should apply for more credit.

Mortgage lenders are not the only lending companies to use this metric. If you want to apply for a credit card or an auto loan, lenders may use your DTI to make a decision. If your DTI is too high, you might not be approved because you will be seen as a greater risk to lend money to.

There are two different types of DTI, your front-end DTI and your back-end DTI.

Your front-end DTI takes into consideration your mortgage payment compared to your income, while our back-end DTI takes into account all debt obligations with some exceptions. These exceptions are your health, auto, or any other insurances, entertainment subscriptions, food expenses, gas and transportation expenses, other utilities, and your RENT. It is also calculated before your taxes are taken out of your paycheck.

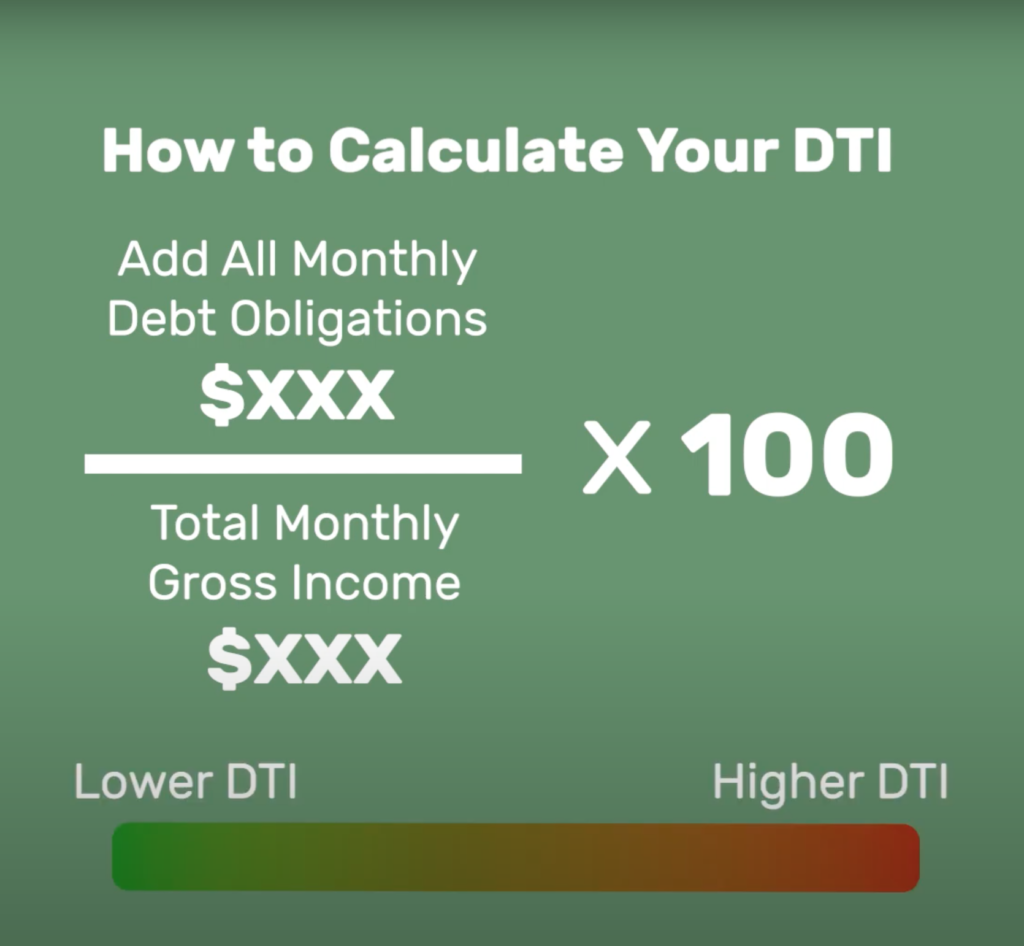

How to Calculate DTI:

In order to calculate your debt-to-income ratio, you need to add up your monthly gross income before taxes. Make sure this must include all sources of income.

Next, add up your monthly debt payments. If you’ve already created a budget, this should be easy. Be sure to include credit cards, auto loans, mortgages, and so on. You should only include the minimum payments for these bills. If you have $5,000 in credit card debt, but the minimum payment is $25, then you would only use $25 when making your calculation.

The final step in calculating your debt-to-income ratio is to divide your total monthly debt payments by your monthly income gross. To get a percentage, move the decimal point over to the right two times.

The lower the number the better because you have a higher ratio of income compared to your debt. If your ratio is high, then lenders won’t lend you money because they may think you won’t be able to pay them back your debt.

What Is A Good DTI?

This will depend on what you want to do.

Generally speaking, lenders look at your back-end DTI when making lending decisions. A back-end DTI of less than 36% is considered good. If you’re applying for a credit card or a car loan you don’t want to be any higher than 43%. Once you go beyond 43%, you’re likely to have trouble paying your bills.

If you’re looking to buy a house, the numbers are calculated a bit differently because they are looking at your front-end DTI. When applying for a mortgage your front-end DTI needs to be less than 31% if you’re going through an FHA-insured loan. For non-FHA-insured loans, your front-end DTI max must be less than 28%. If you are good on your front-end DTI, your back-end DTI still needs to be below 43% to get approved for a mortgage by most lenders.

Take Our FREE Credit Literacy Quiz!

In just a few minutes, discover your credit knowledge level and get instant access to a FREE credit education course tailored to you!

Important Cautionary Tip:

If your DTI is high, generally above 46%, you are likely able to afford your monthly expenses. However, you are probably not saving as much money as you would like to.

As this percentage increases, you likely feel a greater financial burden to meet these expenses. You probably have to work harder to make your budget last you from paycheck to paycheck. This is why it’s so important to keep your debt obligations under control and keep them as low as possible.

Pro tip: You can always pause or cancel a couple of monthly subscriptions for a few months and spend less money eating out, but you can’t skip paying rent, your car payment, mortgage payments, credit cards, or student loans without risking defaulting on your loans and facing serious consequences.

How does my DTI Impact my credit score?

Your income does not have a direct impact on your credit score. However, 30% of your credit score is based on your credit utilization rate, or how much debt you are using compared to the total credit you have available. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score.

The only way to bring your utilization rate down is to pay down your debts or to increase your total available credit. Having an accurately calculated ratio will help you monitor your debts and give you a better understanding of how much debt you can afford to have.