Homeownership , Renting Tips - 4 mins read

Financial Tips

After all…reporting your rent is just the start. We help you get serious about your finances!!

Tools

Explore all Resources Of Homeownership

Homeownership - 11 mins read

How Much Down Payment Do You Really Need To Buy a House?

Stephany Lamas , Student Account Manager

Homeownership - 11 mins read

What Not To Do Before Buying a House

Stephany Lamas , Student Account Manager

Homeownership - 9 mins read

How to Save Money For a House

Stephany Lamas , Student Account Manager

Homeownership , Renting Tips - 8 mins read

Rental Payment History Now Included In Fannie Mae & Freddie Mac’s Underwriting Process

Aileth Kim , Student Account Manager

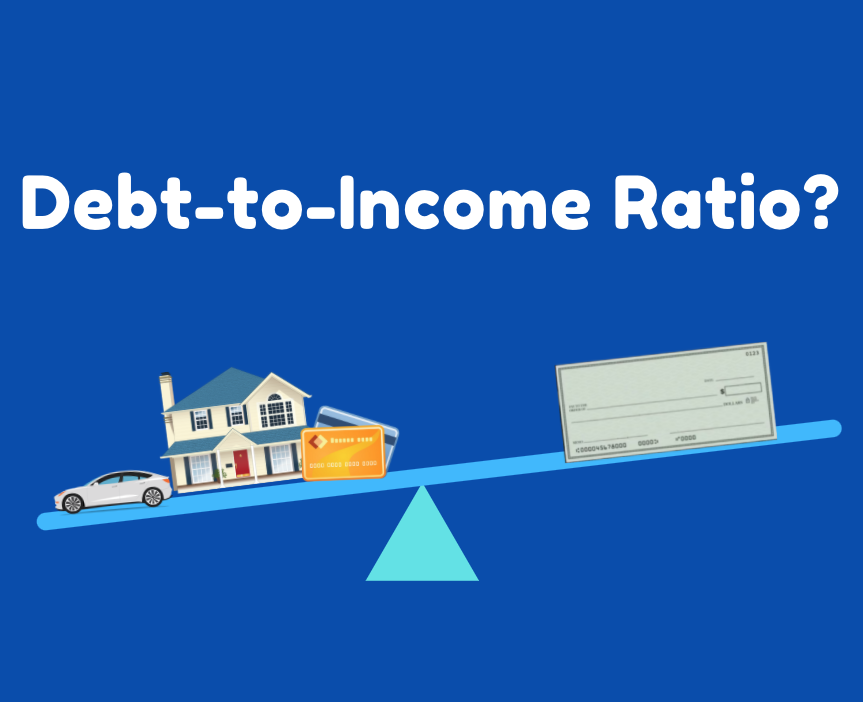

Homeownership , Personal Finance - 7 mins read

How To Calculate Your Debt-To-Income Ratio

RentReporters , Student Account Manager

Credit Education , Homeownership - 7 mins read

What Credit Score Do You Need To Buy A House?

RentReporters , Student Account Manager

Customer Success Stories , Homeownership - 2 mins read

How Rent Reporting Can Help You if You Want to… Buy Your Dream Home

RentReporters , Student Account Manager

Credit Education , Homeownership - 2 mins read

What if You Could…Improve Your Score and Buy Your Dream Home

RentReporters , Student Account Manager

Homeownership - 1 min read